Sector battles wake of pandemic and supply shortages to remain on top despite decline in project-starts.

Glenigan, the construction industry’s leading insight and intelligence experts, releases the August edition of its Construction Index.

This report provides a detailed and comprehensive analysis of year-on-year construction data, giving built environment professionals unique insight into results from the second quarter of 2021 and the last twelve months.

Signs of success

Despite a slight setback for underlying work (less than £100 million in value) in Q.2 of this year dropping 16% on Q.1, the construction industry is regaining its feet. A rise of 36% on figures in the same time period in 2020 show a sector on the way up.

Residential work on the rise

The value of residential work being carried out on-site is also on the rise, climbing 36% against the previous year. However, this fell 28% compared with the preceding three months and is down 33% on 2019 figures.

Private housing has also shown growth as one of the best-performing sectors, with the value of project-starts rising by over half (54%). Again, these figures are off the back of an initial dip, down 29% on the preceding three months of this year and 32% on 2019 levels.

Retail and offices provide boost

Retail was the stand-out sector during the period, with project-starts having increased 169% against the previous year up 94% compared with the same period in 2019. Retail-starts also doubled compared with the preceding three-month period in 2020.

Non-residential sectors also performed above 2020 figures, climbing 45% and increasing by 8% in Q.2 on three months previous.

Health projects show vitality

Despite a slight dip in health project starts in Q.2 of this year falling 12% on Q.1, the sector has seen a 7% rise on the previous year and a 43% increase on the same period in 2019.

Similarly, hotel and leisure project-starts have performed poorly in recent months, however, sector growth has nearly doubled against the previous year (94%) and increased 52% on Q.1 of 2021.

Improvement needed for infrastructure and civil project-starts

An area in need of improvement is underlying civil engineering project-starts which increased just 1% on 2020 but fell 41% on the preceding three months. This was also down 40% compared with the same period in 2019.

Infrastructure starts were also down 16% on the previous year and 49% compared with Q.1 of this year. The sector was also declined by 43% on the same period in 2019.

However, utilities starts show much more promise, increasing by nearly a half on 2020 (47%) but down 18% on the preceding three months of Q.1 of this year.

Strong growth for Scotland

Scotland has been leading the Covid-recovery, achieving strong growth of 124% on the value of project starts against the previous year, this is despite a 14% dip compared with the previous three months of this year.

Yorkshire and the Humber also achieved three-digit growth on 2020 (110%) and project-starts in London climbed by over 50% against the previous year but was down 8% on Q.1

Project-starts in the East of England also rose by 58% against last year and were the only region to experience growth against the preceding three months (8%).

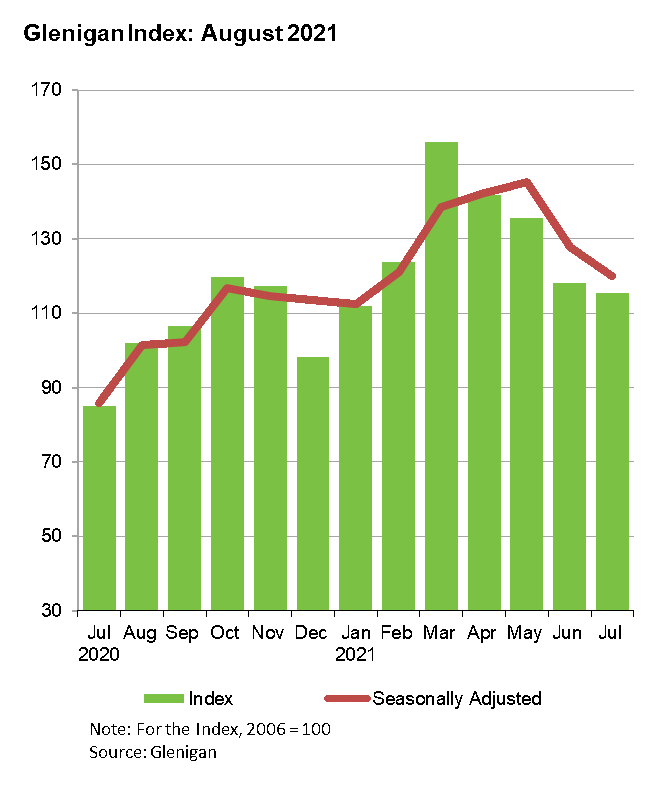

Rhys Gadsby, Glenigan’s Economic Analyst, commented on the latest figures: “While the value of project-starts remains substantially higher than the lockdown-affected previous year, the value has continued to decline in recent months. Material supply problems may have contributed to the fall; however, a decline was expected following a surge in activity, due to pent-up demand, during the first quarter.

“More positively, the speed of decline slowed during July. Main contract awards and detailed planning approval were high compared with previous years, so it is only a matter of time before this has a positive impact on project-starts. Furthermore, the successful vaccination roll-out, as well as the ending of restrictions on daily life, should give investors – particularly in non-residential sectors such as hotel & leisure – the confidence to progress projects to site.”

To find out more about Glenigan, its expert insight and leading market analysis click here.