As businesses around the U.K. work towards reopening and re-establishing their operations, there may be a tough road ahead for companies to return to good financial health.

Referencing an article in The Times, analysis by the Office of National Statistics (ONS) shows that nearly half of all U.K. businesses do not have enough cash reserves to see them through November. Results of a survey of almost 5,000 U.K. companies between 4th May and 17th May, showed that 42% of companies were found to have less than six months’ worth of cash reserves, and that number rose to 58% for companies who had paused their operations during the coronavirus lockdown.

Barry Nicholson of Snorkel Finance said: “Businesses have been seriously affected by the Coronavirus situation, and liquidity cannot be immediately restored at reopening. Many of our customers are likely to experience business reserves running dry in the coming months as invoices take longer to be paid, if they are paid at all. Companies are going to need to financially restructure in order to survive, and ultimately, thrive.”

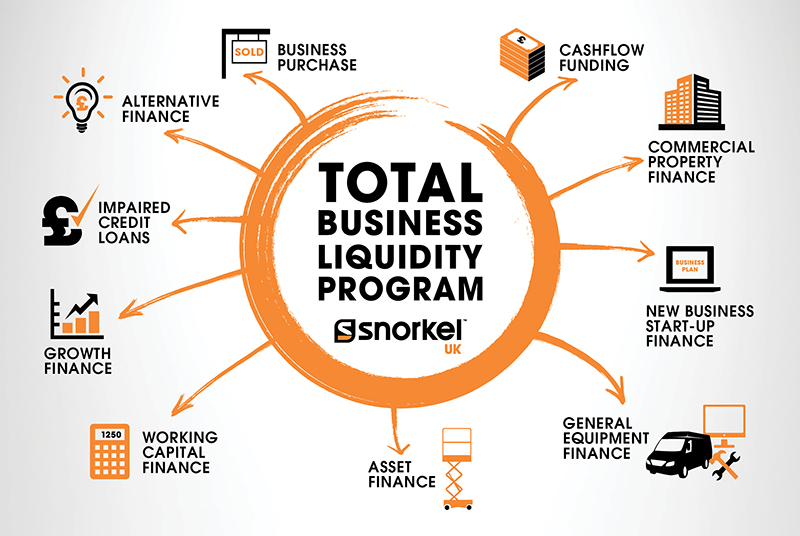

In response to this situation, Snorkel Finance has taken what is describes as a unique approach to developing a total funding solution to provide business-wide liquidity for Snorkel UK customers. Snorkel Finance has broadened its funding panel to include all types of business funding, not limited to just asset-based funding. With access to more than 300 specialist funders, Snorkel UK customers can spread their risk by not relying on a single funding source, and have access to an extensive range of financing products from both existing funders and new finance providers in the Fintech sector.

Providing an alternative to high street banks and lenders, available products from the new business liquidity program include, but are not limited to, cashflow finance, commercial property finance, funding for new start-up businesses, general equipment finance, working capital finance, growth finance, impaired credit loans, alternative finance, and business purchase.

“It’s not all about the money. But, guess what? It’s all about the money,” added Barry Nicholson. “Our new business liquidity program responds to the real issues that our customers are facing right now and provides a one-stop solution for inclusive business financing support that not only helps through the short-term challenges, but also establishes a strong financial structure for the businesses to grow and prosper in the years to come.”

Andrew Fishburn, Managing Director of Snorkel UK and Vice President, Strategic Accounts (EMEA), Snorkel, said: “At Snorkel UK, we always take a holistic approach to supporting our customers and this new liquidity program takes it to a new level. We know how tough the environment is right now, and we are proud to be taking an innovative and responsible approach to financing which can bring real, long-lasting value to our customer base. This is about more than funding equipment, it’s about making sure our industry comes through these challenging times in good shape, ready for the years ahead.”

To learn more about the new business liquidity program from Snorkel Finance, available to businesses in the United Kingdom subject to status, visit www.snorkellifts.co.uk/liquidity