Glenigan, one of the construction industry’s leading insight and intelligence experts, and CITB, the construction industry training board, announce the launch of the 2019/2020 UK Industry Performance Report.

This carefully researched document offers a detailed snapshot of the sector’s performance over a given timeframe, measured against a broad set of criteria, including productivity, profitability, safety, welfare, and sustainability. Delivered with the input of a broad, cross-sector range of clients and contractors, each respondent was asked to give a score from 1-10 in each instance, with one being ‘not satisfied’ and ten being ‘completely satisfied’.

The latest iteration is a valuable tool, supporting continued improvement within UK construction, and paints a generally positive picture in the timeframe covered (2018 & 2019).

Significantly, despite the anomalous 2020 (and first half of 2021), it highlights how the sector was in a position of strength entering the pandemic. This meant it was better placed to weather the socio-economic storm, coming through the other side relatively unscathed, making a quick recovery.

Overall Client Satisfaction

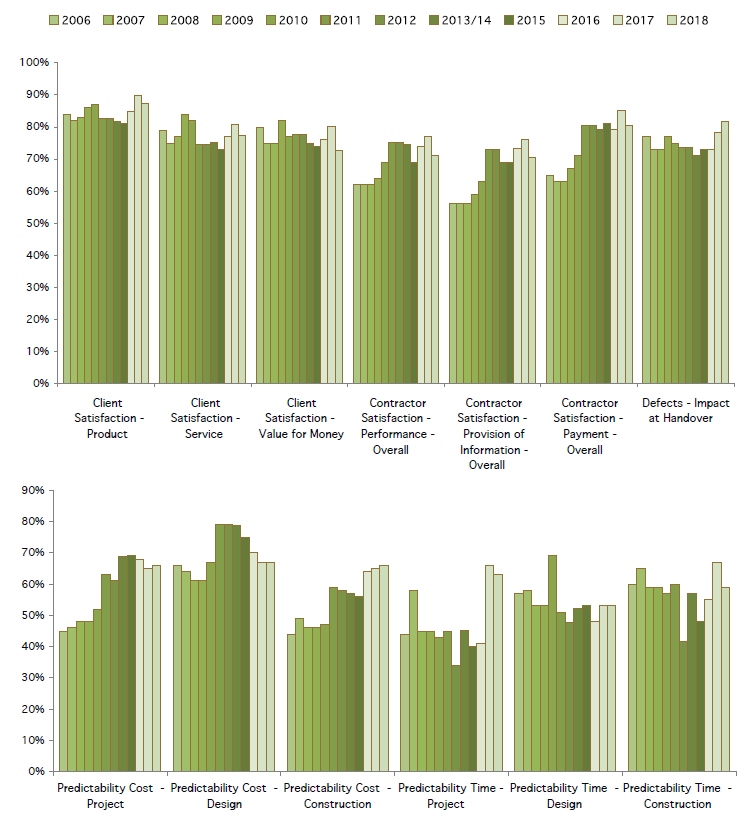

Central to the report findings, high levels of satisfaction were registered from construction sector clients over the period covered in the report, particularly concerning build quality, service delivered and value for money.

Affirming this summation, client satisfaction with the finished product rose by five percentage points to achieve its highest rating to date, with 92% giving a score of 8/10 or better.

This was reflected on the contractor side, as satisfaction with client performance and provision of correct information, as well as positive perceptions of the consultancy team, rose on the previous survey.

A Safer Sector

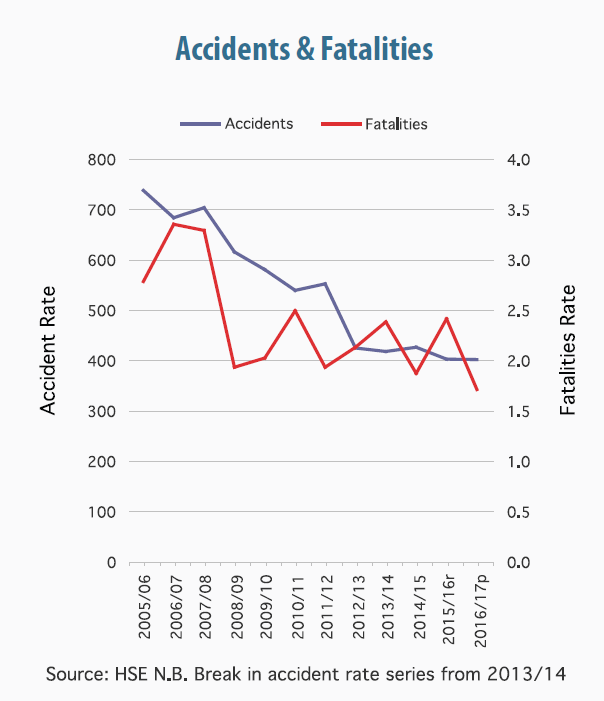

Another positive registered from the results was a further reduction in overall accident incident rates, mirroring the downward trend seen over the last two decades.

Overall Accident Incident Rate (AIR) rate, at 366 accidents per 100,000 employees during the period covered by the last survey showed a marked improvement, a 9% drop on the previous year. Encouragingly, the fatality rate also fell to a new low of 1.6 per 100,000 employees.

This further highlights and emphasises the positive work being done by both Government and industry to make construction work safer across the board.

Great Expectations

Overall the KPI results revealed that, prior to the pandemic, the industry was generally meeting client expectations. However, a number of structural issues were repeatedly highlighted by respondents which have, incidentally, persisted throughout and beyond the pandemic. These included: productivity, profitability, an ageing and un-diverse workforce and meeting Net Zero 2050 targets.

One important area which saw generally negative responses was against the environmental KPIs. Measures of energy usage, waste removal, and commercial vehicle movements all worsened compared to recent years’ performance.

Digging deeper, on-site energy usage rose with median energy use at 376.4 CO2 per £100k of project value, 11% higher than 2018.

Additionally, mains water use rose 13% on the previous survey and the median commercial vehicle movements jumped 67% to 24.5 CO2 per £100k of project value. Finally, the KPI for median wares removed from site was up 33% to 24.4m3 per £110k project value, the highest levels since 2010.

Following 18 months of lockdown and COP26 in a couple of weeks’ time, it will be interesting to see if this worrying resurgence in waste and emissions has been reversed.

Housing focus

Looking at the residential sector specifically, clients’ overall satisfaction with housing projects delivered remains high, with almost 90% of respondents giving the overall received product 8/10 or higher.

Although satisfaction with services received slightly weakened by 2% (84%), satisfaction with impact of defects at handover rose by 10% with 80% respondents scoring 8/10 or higher.

Improvements were also registered in: the predictability of projects being delivered on time and budget (79%), predictability of design and construction coming in on cost or better (75%), and reports of the construction phase coming on or below budget (67%). Each saw a marked percentage increase in scores of 8 or more.

Non-Housing

Satisfaction remained high for non-residential clients.

A record 89% of clients of non-housing projects scored 8/10 or higher for satisfaction with the overall project.

Service satisfaction has also improved, with the proportion of clients rating their impact as 8/10 or higher, jumping eight points to 83%, with defect satisfaction remaining unchanged on 2018 at 84% of respondents giving a score of 8 or higher.

Conversely, design cost predictability deteriorated, with 66% indicating a successful completion to budget or better. Predictability of construction costs also slipped, after three consecutive years of improvement, with 70% of projects being to cost or better.

However, time predictability has improved with 60% of projects completed on time, up from 56% in the previous survey.

Commenting on the stats, Glenigan’s Economic Director, Allan Wilen, says, “These results show an industry exhibiting signs of recovery pre-pandemic, indicating how it was able to rebound so quickly from the events of the last 18 months. However, it also revealed a handful of legacy issues UK construction is still trying to address.

He continues, “Adapting to life outside the EU will inevitably create volatility, and it’s already increasing pressure on firms’ margins. Combine this with the need to upskill, improve workforce diversity, materials shortages, digital adoption and emissions reduction and you see a sector which needs to evolve, and fast. However, we should recognise opportunity when it presents itself. These results show that, generally, we’re moving in the right direction, and should continue to do so.”

Lee Bryer, Industry Insight Manager at CITB adds, “The results show that pre-pandemic the industry was generally performing well, but with some room for improvement. Profitability and predictability and increasing levels of client and contractor satisfaction were all looking positive. However, finding sustained productivity gains continued to prove more elusive.

“Post-pandemic the industry is operating in an environment with higher costs and supply chain disruptions so it will be a positive sign if improved performance in predictability can be sustained. The labour market has also gone through significant change over the past two years as a result of Brexit and the pandemic, which means the industry will need to focus on upskilling the existing workforce and double-down on efforts to attract the new entrants who will drive improved performance going forward.”

To find out more about the 2019/2020 UK Industry Performance Report click here.