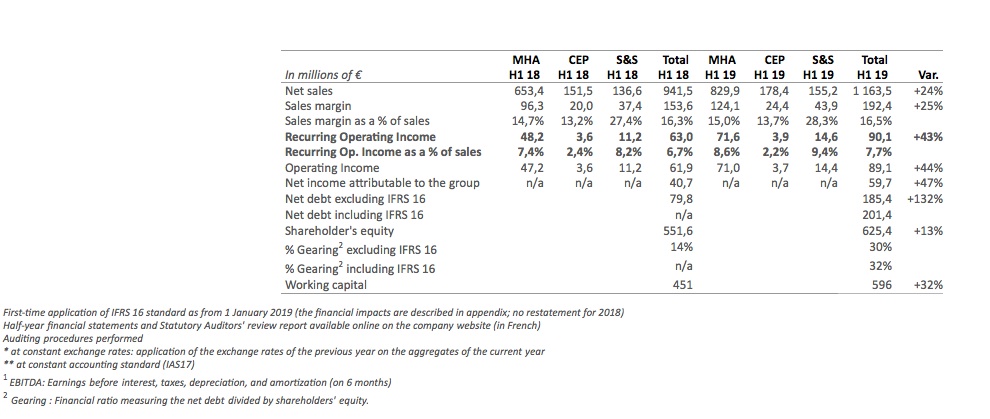

The board of directors of Manitou BF, meeting on this day, closed the accounts for the first half of 2019.

The group achieved another record semester with revenue growth of 24% compared to H1 2018 and a recurring operating income of 7.7%, up 100 basis points compared to H1 2018.

Michel Denis, Chief Executive Officer, said: “Over the first half of the year, business was very strong in our three markets of construction, industry and agriculture, as well as in almost all geographical areas. High production levels made it possible to sell the excess order book that the group had accumulated at the end of 2018.

This performance contrasts with order intake, which is now showing a decline. A difficult-to-quantify part of this decrease is due to the return to normal delivery times, which prevent our customers from having to anticipate their orders well in advance. Another part is due to a significant drop in some markets such as the United Kingdom or South Africa, as well as a more uncertain global economic environment with no visible signs of improvement in the short term.

The group is reducing its production volumes and gradually limiting its structural costs and investments.

Given the historical invoicing level for the first half of the year, our expectations for 2019 of revenue growth of more than 10% compared to 2018 and recurring operating income in the order of 7.3% of revenue, remain confirmed. All teams are still committed to continuing the group’s strengthening and transformation projects.”

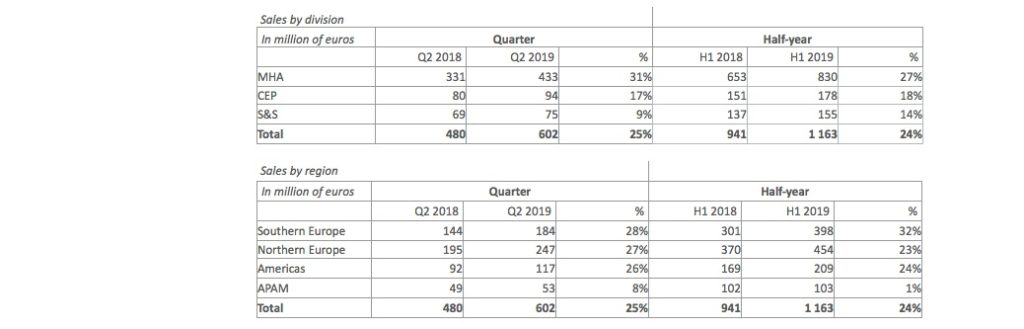

Sales trend

Review by division

The MHA – Material Handling & Access Division achieved half-year revenue of €830m, an increase of +27% compared to H1 2018, +27% also at constant exchange rates. Growth was very strong in all markets, with significant business with European rental companies.

Faced with the slow-down in demand, all production sites are organizing themselves to adjust their capacities, a situation for which they had made part of their direct and indirect means of production more flexible.

Recurring operating income represented 8.6% of revenue, up 120 basis points compared to H1 2018.

The CEP – Compact Equipment Products Division achieved revenue of €178m, a rise of +18% compared to H1 2018, +12% at constant exchange rates.

During the first half of the year, business was buoyant, particularly with North American rental companies. The division continues to be impacted by the evolution of the dollar, which increases the cost of its exports outside the United States. In order to adapt to a less favourable environment, the division has initiated an adjustment of its production capacities on its American sites.

The division’s recurring operating income was positive at 2.2% of revenue and 2.9% at constant exchange rates, compared with 2.4% in H1 2018.

With a turnover of 155 M€, the Services & Solutions Division (S&S) recorded a +14% increase in its activity, +13% at constant exchange rates boosted by the used equipment sales service activities.

In addition, the division continues to work on strengthening the supply of connected machines and sales financing.

The recurring operating income to revenue ratio was 9.4%, up 120 basis points compared to H1 2018.