Retail sales of construction and earthmoving equipment declined further in December 2023, resulting in Q4 sales ending up at 29% below Q4 2022 levels, according to figures from the CEA.

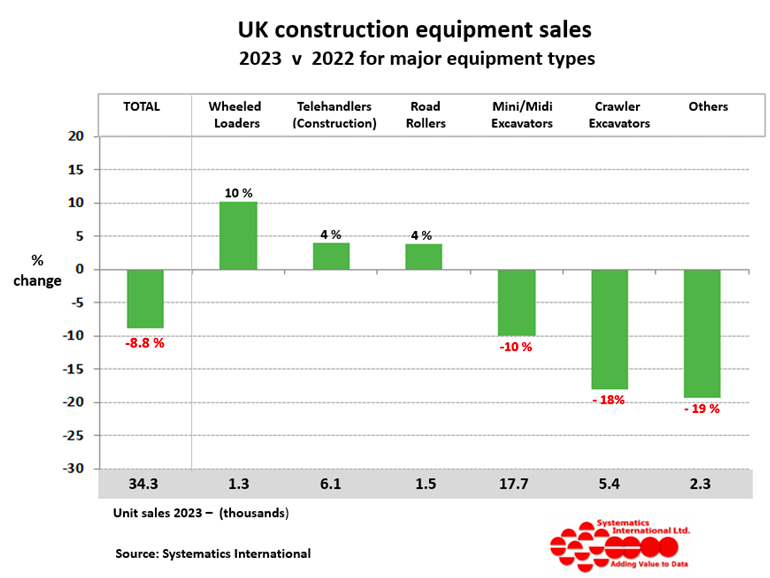

This was the lowest quarterly level of sales since Covid at c. 6,500 units. For the full year, sales in 2023 reached 34,300 units and were 8.8% below 2022 levels. This was 2,000 to 3,000 units below the level of equipment sales seen in 2021 and 2022, but these were the highest years since the financial crash in 2008.

The year was a tale of two halves. In the first six months, sales were 8% above 2022 levels, but in the second half they dropped to 25% below the previous year’s levels, as demand petered out largely due to a drop in housebuilding.

In terms of what sold and what didn’t, wheeled loaders (+10%) ended up as the strongest-selling product last year. Following strong sales in Q4, telehandlers (for construction) saw the second-highest growth and ended 4% above 2022 levels. The fall in equipment sales overall in 2023 was very much driven by declining sales of excavators, with mini/midi excavator sales 10% below 2022 levels and crawler excavators 18% below the previous year.