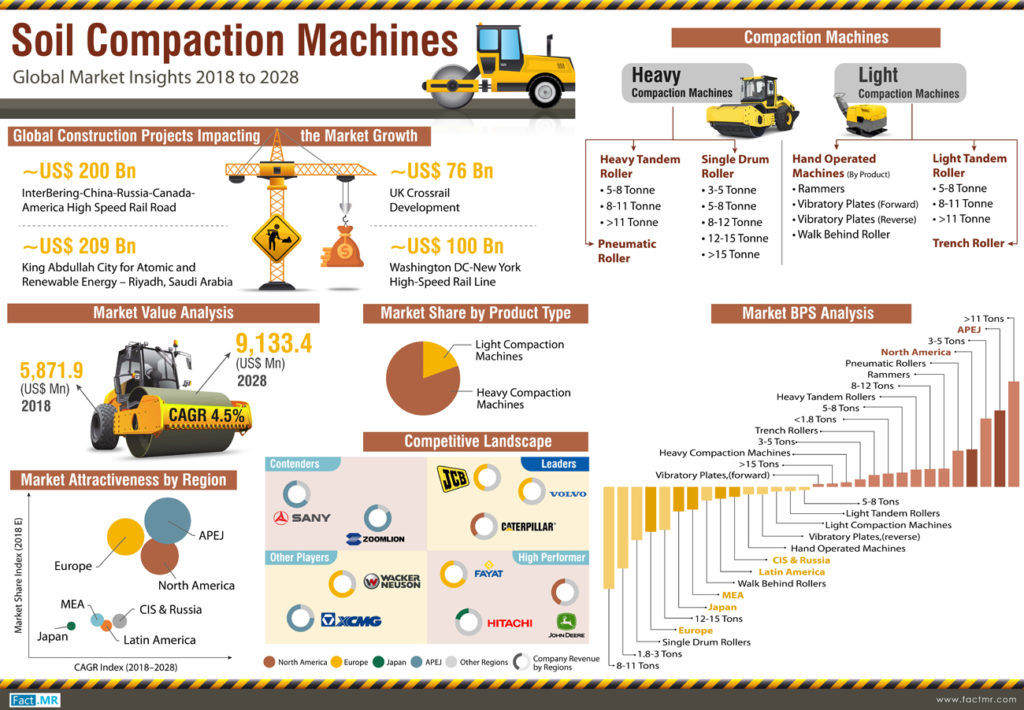

Developments in road infrastructure and increasing demand for paved roads continue to influence sales of soil compaction machines. Highways and roads being a key facet of infrastructure sector in an economy, their construction becomes an imperative aspect. This factor is likely to remain instrumental in driving the demand for construction equipment such as soil compaction machines. Fact.MR foresees that the demand for soil compaction machines is projected to expand at a CAGR of 4.1% in terms of volume during the period of forecast, 2018-2028. Albeit a steady growth rate, demand for soil compaction machines is expected to translate into sales volume of more than 370,000 units by end of the assessment period, envisages the study.

The soil compaction machines market is likely to be impacted with a number of aspects circling the rental trend. OEMs and distributors of soil compaction machines have been inclined toward renting soil compaction machines owing to high initial costs. Mid-level contractors have been facing challenges apropos to raising funds for new soil compaction machines along with managing maintenance costs. This has translated into a significant growth in the soil compaction machines rental trend, consequently influencing its market.

Manufactures of soil compaction machines have been focused on development of their soil compaction machines. Shift from static to vibratory soil compaction machines has been witnessed across the globe, says the report. In addition, soil compaction machines manufacturers are also introducing machines featuring higher fuel efficiency and low maintenance. Furthermore, manufacturers are focusing on introducing based on specific application requirements. For instance, Wirtgen Group has introduced HD 12 VV soil compaction machines that are suited for small road construction and landscaping sites.

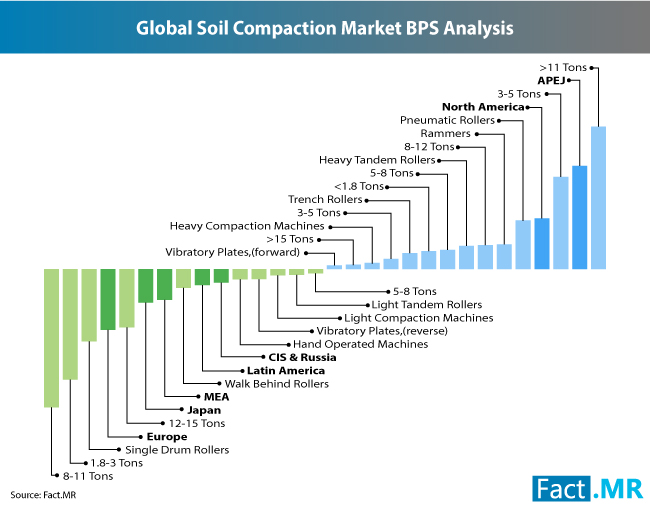

Heavy soil compaction machines is likely to witness significant demand and adoption across major construction projects including highways and airports. However, volume of heavy soil compaction machines sold is expected to remain low as compared to their light counterparts. The study foresees that the volume of light soil compaction machines sold is likely to surpass 190,000 units by end of 2019, in turn leading the market.

Demand for pneumatic rollers in the soil compaction machines marketplace is projected to expand at a relatively higher pace throughout the period of forecast owing to their higher efficiency in soil compaction process. However, the report estimates that sales of pneumatic rollers are likely to remain at a relatively lower base. Sales and demand of single drum rollers, particularly the 8-12 ton and above 15 ton variants, are estimated to account for a significant share in the heavy soil compaction machines and the overall market.

Sales of light tandem rollers as opposed to trench rollers are expected to account for more than 51 percent of the light soil compaction machines marketplace. However, report projects that the demand for trench rollers is projected to expand at a comparatively higher pace during the assessment period on the back of superior productivity and compaction output. In addition, trench rollers can be used in highly cohesive soils. Manufacturers of soil compaction machines are largely investing in improving trench rollers in a bid to enhance longevity and achieve higher customer satisfaction. For instance, Ammann has introduced new Articulated and Rigid Frame trench rollers that offer higher operator safety and comfort with enhanced productivity.

The sales of soil compaction machines are likely to remain concentrated in the emerging economies of Asia Pacific excluding Japan (APEJ) region, particularly in China and India. Increasing number of road infrastructure projects, including Super Highway project in China and Highway Super System project in India, are likely to influence demand for soil compaction machines. The demand for soil compaction machines across European countries is also projected to increase at a noteworthy rate during the forecast period, says the report. Manufacturers of soil compaction machines can expect a positive outlook in the APEJ market with momentous growth in the forthcoming years.