According to Fact.MR estimations, the asphalt pavers market will witness volume sales of over 34,600 units in 2018, a marginal growth from 2017.

Overall growth of the market is driven by:

- Use of predictive maintenance systems in construction equipment to prevent downtime and reduce operating costs

- Improved fleet management with different financing and equipment acquisition options

- Development of efficient asphalt pavers with improved screed operations and maneuverable paving width

The study reflects that the expansion and improvements in road infrastructure are the prime fillips responsible for asphalt paver sales in the construction equipment market. Airport paving projects are other prominent consumers of asphalt pavers wherein construction equipment companies are focusing on the procurement of big-ticket projects.

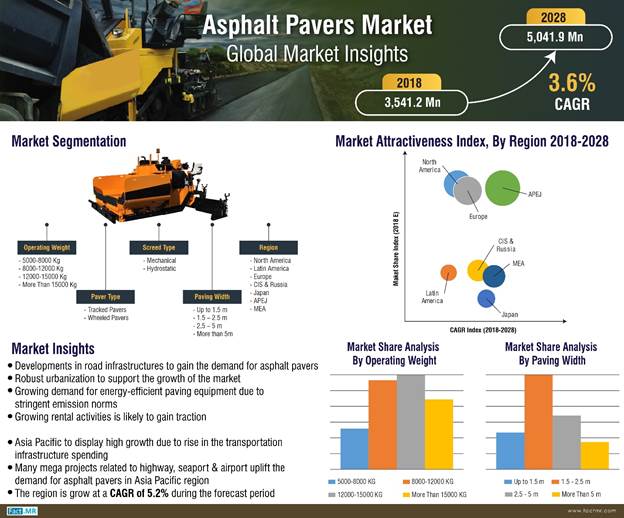

North America to Hold over One-Fifth Volume sales, APEJ Progresses Rapidly

Volume sales of asphalt pavers in North America are headed up by the extensive and longest road infrastructure in the United States. The study estimates that North America will continue to report for bulk demand in 2018.

Europe will closely follow North America in terms of volume sales in 2018. APEJ will continue to witness significant revenue increase of 4.9% Y-o-Y in 2018 over 2017.

“Growing emphasis on prolonging the lifespan of existing road and highway infrastructures and increasing public and private investments are major factors fuelling the demand for asphalt pavers. As construction companies are vying for low operating costs and higher productivity, the asphalt pavers market has witnessed the introduction of some of the excellent, high-performance models of asphalt pavers in past half a decade,” says a senior analyst at Fact.MR.

The study finds that tracked pavers will hold over 73% of the market share in 2018 wherein asphalt highway and airport pavement projects highly prefer tracked pavers over wheeled pavers. Wheeled pavers continue to register steady demand, especially in patch paving applications or paving projects of town or city roads.

Demand for hydrostatic screed continues to gain traction among end-users owing to its superior function that provides uniform screed across the road surface. The study estimates that volume sales of asphalt pavers with hydrostatic screed will hold over two-thirds share in 2018.

Asphalt Pavers with 1.5-2.5 m Paving Width Held over Two-Fifth Volume Sales in 2017

Paving width and operating weight are two of the prominent features that according to Fact.MR remains crucial for construction companies in optimizing the investments. The study estimates that owing to the involvement of low engine power and economical nature, screeds with paving width ranging from 1.5 – 2.5 meter are highly sought after and will register over 40% of total volume sales by the end of 2018.

On the back of increasing mega projects across developing economies, Fact.MR envisages that asphalt pavers with paving width of more than 5 meters will register rapid expansion.

Pavers with 8000-12000 kg operating weight will remain preferred as this range of operating weight, as per the study, provides cost-effective operations throughout the construction project. Asphalt pavers with 8000-12000 kg operating weight will witness moderate growth from 2017 to 2018.

In the consolidated landscape of the construction equipment industry, the asphalt pavers market presents the dominance of a handful of market player wherein study valuation finds that Tier 1 players hold over 64% of the total market share.

Procurement of big-ticket projects continues to remain prominent strategies of Tier 1 companies in the asphalt pavers market. For instance, construction equipment fleet of over 50 machines from Wirtgen Group is being utilized in the New Istanbul Airport, world’s biggest airport project. Another instance is of Dynapac wherein a fleet of Dynapac machine is utilized by Kuwait’s largest construction company Galfar Engineering and Contracting to aid road and infrastructure projects in Kuwait.